Hits:Updated:2018-05-30 17:05:04【Print】

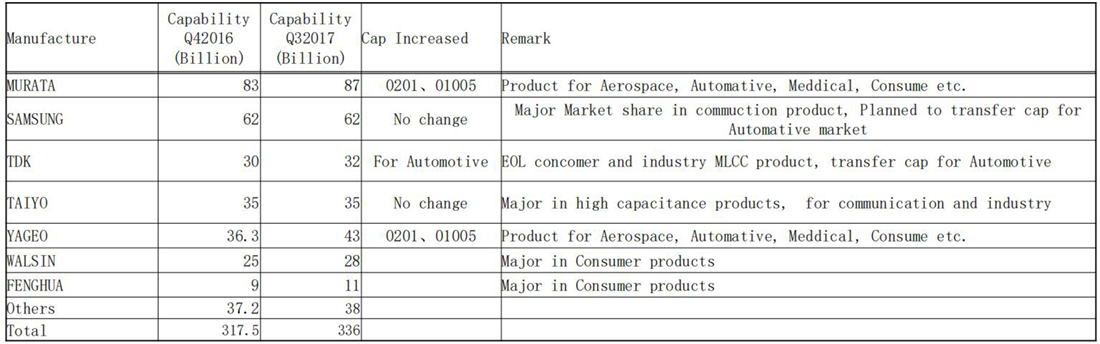

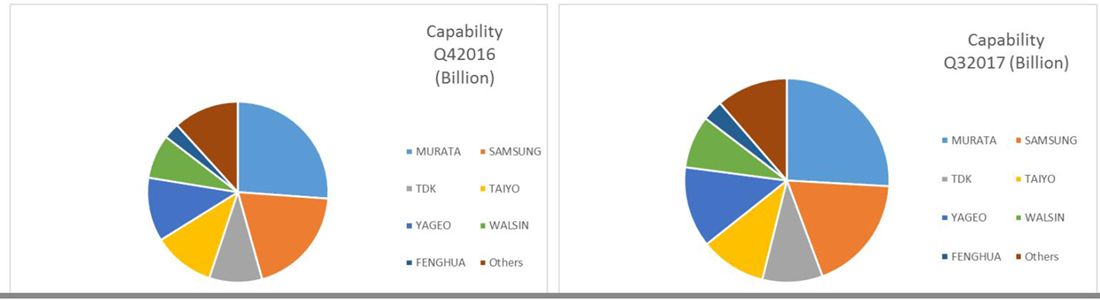

| MLCC Current Supply Situation 1、MLCC increase Lead-time from Q42016, the lead-time increased 4wks→ 8wks→12wks,and now increase to 26wks for some of items. 2、MLCC factories refused confirm delivery before allocation made. 3、For allocation parts, factories need keep to support top 10 customers and limited to accept new orders from other customers. 4、Delinquent on confirmed orders frequently. 5、Top customers all held meeting and made agreements with factory for shortages and future delivery support. Major MLCC Factories and Capacity   Main issue of Shortages ◆ Decrease Output 1, Due to Automotive products strong grow up, the Japanese manufacturers make strategic transfer capacity to support the market. TDK abandon MLCC consumer market in early 2016, and fully support Automotive

market.

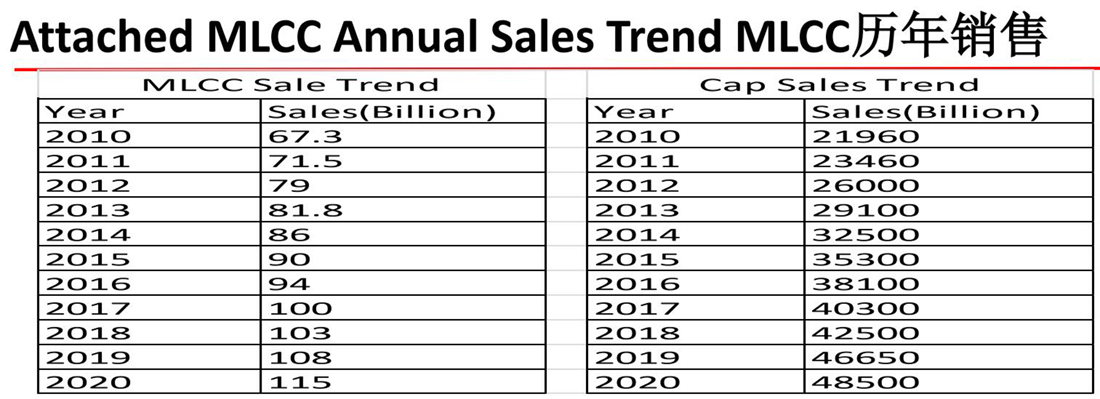

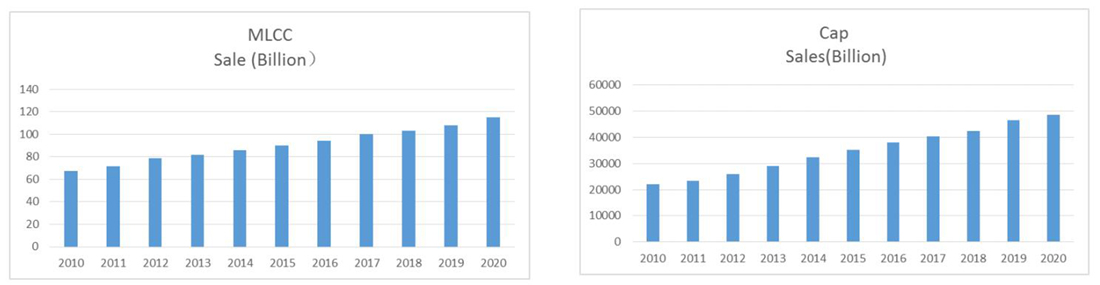

2, Murata also announced decrease output for 0402, 0603, 0805, 1206 below 1UF products, transfer to Automotive product, such as Kyocera, Taiyo Yuden, Samsung has followed, expected conversion capacity about 20 billion/month. 3, SAMSUNG influenced by NOTE7 phone explosion, improve processand quality control, output rate effected, as one of the biggest MLCC supplier of consumer products, had a huge impact. ◆Demand Increased 1、New product design increased usage for Caps, like iphone7 used 700pcs of MLCC ,iphone8 used more than 1000pcs of MLCC,Automotive MLCC usage is 3~5 timed compared gas car. 2、Internet of things、AI(artificial intelligence)becoming popular,Intelligent functions require electronic components to be realized. 3 、 The overall dosage of MLCC in 2017 is expected to increase by about 6-8% over the previous year. ◆ Production Expansion Tardily 1、In the past few years, most MLCC manufacturers’ profitability are not so good as expected(exceptMurata), and whether the market is sustainable in the future, everyone is watching, the willingness to expand dramatically is not very strong. 2、Most of the equipments for producing MLCC is more sophisticated and expensive, which aremainly customized in Japan, with long time and large capital investment. 3、 The process of producing MLCC is complex. There are more than 20 processes, the equipment,the material, the process match and mature need certain time. ◆ New manufacturers in the field is not so much. 1、 High capital: many equipments, high unit price, need to import the equipment, highrequirements for the manufacture plant. 2、 High technology: more than 20 processes, need to master materials, technology, equipment and other technologies. 3、 High brand: the top ten MLCC brands in the world, the users are already clear and familiar with the advantages and disadvantages of each brand, and the new brand customers are not afraid to use it, they cannot easy to judge the product good or bad, only recognize the brand. Cost Analysis 1、 The price of the main material ceramic powder for MLCC in 2017 Q2 starts to increase, the range is 10-15%. 2、 The price of silver, palladium and copper for electrode metal is inceresed about 10% to 35%. 3 、 The price of capacitance packaging materials (carrying and outer packing) will continue to increase in price in 2017, with a range of 30% to 40%. 4、Labor costs rise, pushing up manufacturing costs. Price Information 1、 The supply and demand imbalance, in order to guarantee their own supply, some of the bigfactories initiative raises the price (from 15% to 200%) to the capacitor factory to sweep goods,pushing up the market price. 2、 From the fourth quarter of 2016, the price of MLCC has been raised, and it has been continuinguntil now. 3、 The price will be increased by 10% ~ 1000%. Such as the 3X104. 4、 Individual manufacturers to take a bid, success of highest-price-offer. 5、 Price increases from individual materials → Almost total series price increases. 6、 Most manufacturers provide products depend on the price. Market Forecasting The expansion will for conventional type of MLCC to all Japanese manufacturers is not strong, the expansion rate in other manufacturers is in10%-15%, to the Q3, they is expected to increase to 18.5 billion a month. However, it is still not enough capacity for digesting 25 billion the transfer capacity from automotive grade product. With the undigested gap of about 60 billion pieces before Q3, to 2017 Q4, we expected cumulative gap(in the absence of the amount of increase) is about 83 billion pieces. And this out of stock situation will be continue to the year 2018 Q4.   |

浙公网安备33021202001960号

浙公网安备33021202001960号